The tourism tax will be officially enforced from Sept 1, said Tourism and Culture Minister Nazri Aziz, Star Online reported.

Malaysians and permanent residents would be exempted from paying the tax.

Foreign tourists will be charged a flat rate of RM10 per room per night for all types of hotel rooms.

The tax will not apply to homestays and kampung stays registered with the ministry and premises with fewer than four rooms.

The government expects to collect about RM210 million in tourism tax annually.

Nazri said 3,200 providers of accommodation had registered with the finance ministry for the tourism tax.

The government initially proposed to tax both foreigners and Malaysians at the following rates: RM2.50 for non-rated hotels and RM5, RM10, RM15 and RM20 for two-star, three-star, four-star and five-star hotels respectively.

Please find below guideline on how to handling for Tourism Tax in AutoCount Accounting without any plugin required, together with the full tax invoice & tourism tax report format for your perusal.

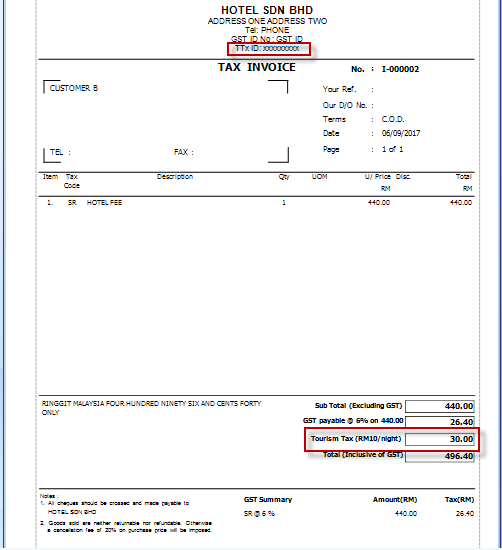

- Key in TTx ID at General Maintenance /Company Profile/Logo & Report Header in order to show in Tax Invoice Report.

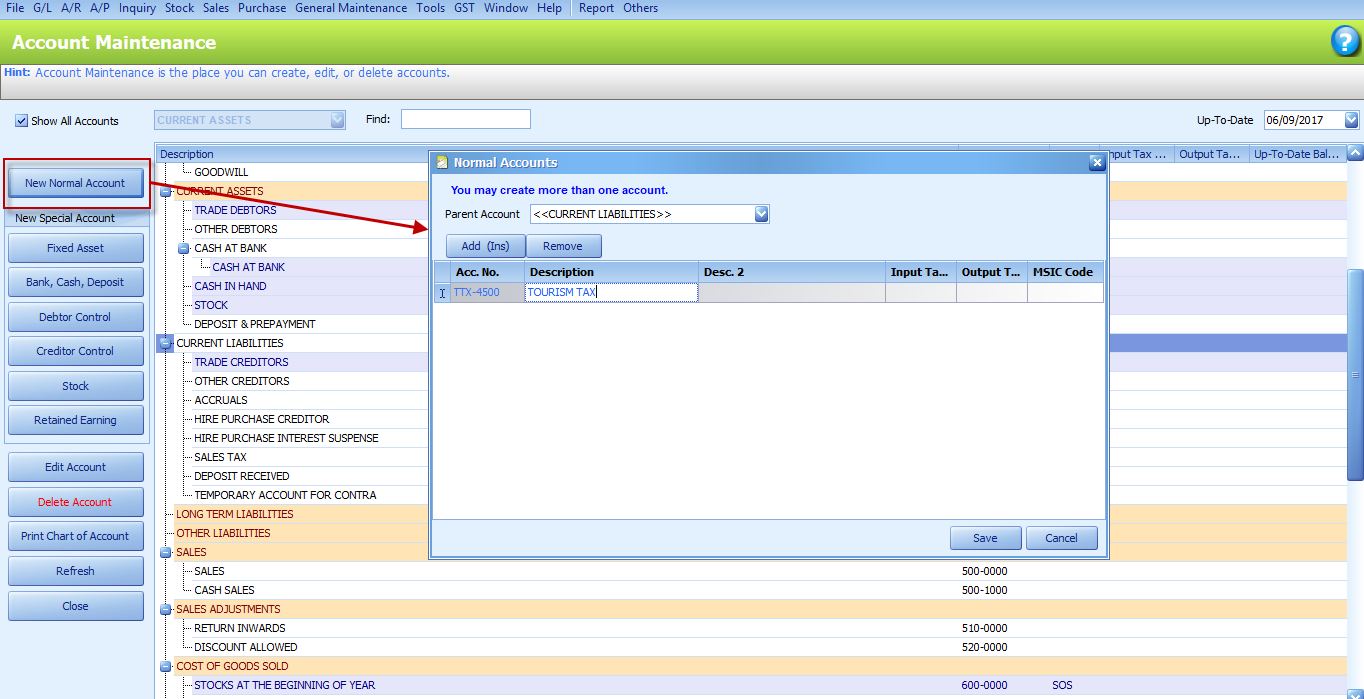

- Create one Tourism Tax (TTX-4500) and Tourism Tax Exemption (TTX-4501)under current liabilities using new normal account.

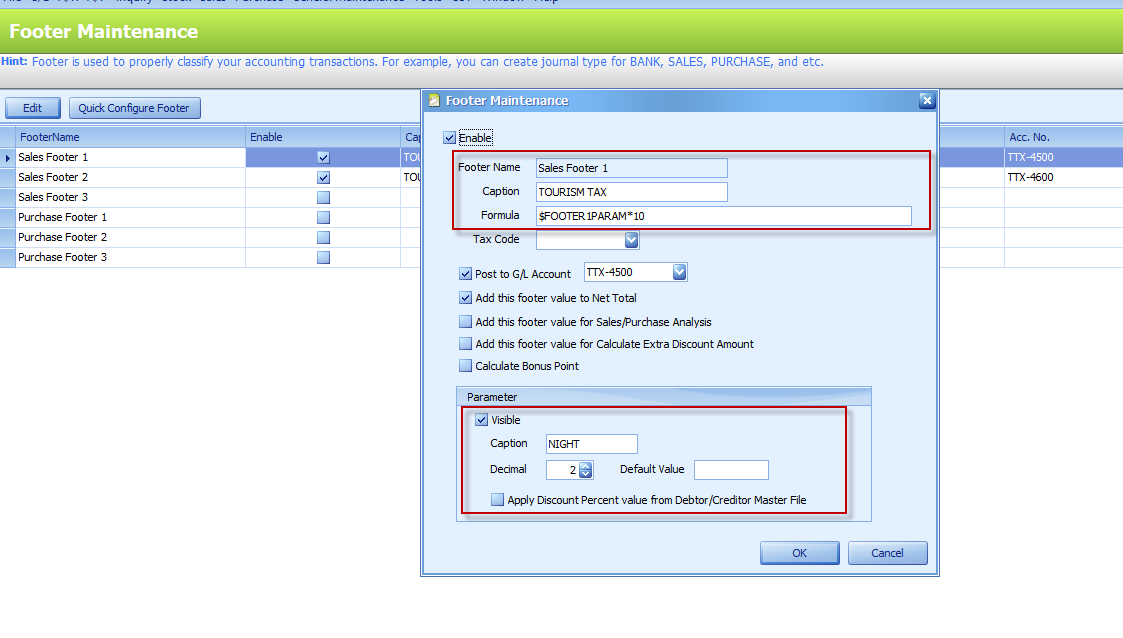

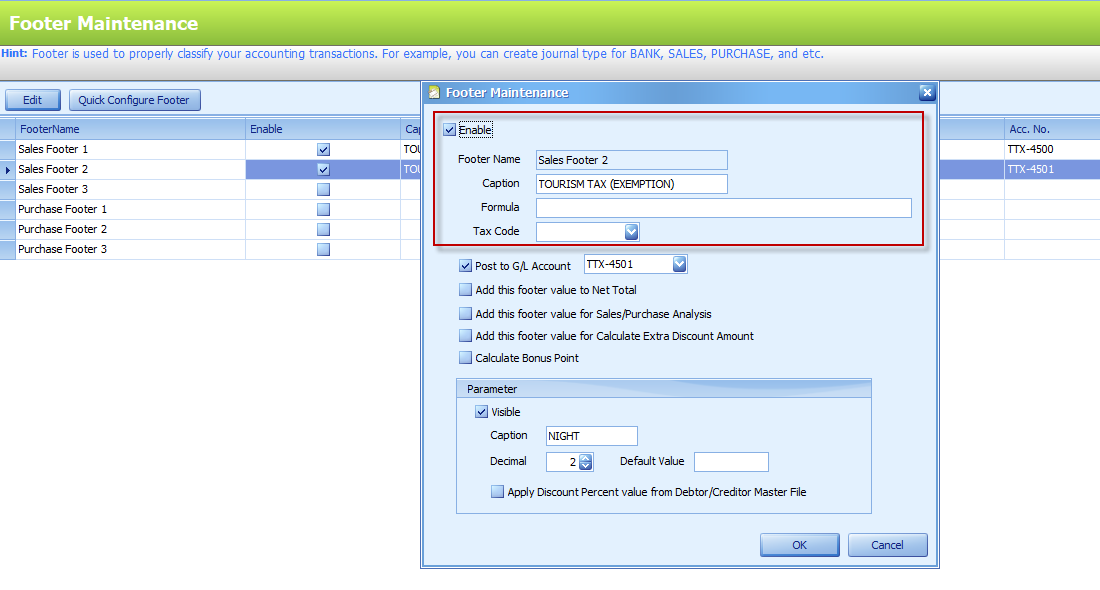

- Go to General Maintenance/Footer Maintenance/enable ‘Sales Footer 1’ and ‘Sales Footer2’.

- Fill in the information at sales footer 1 as per below:

Caption: TOURISM TAX

Formula: $FOOTER1PARAM*10

Tick ‘ Post to G/L Account’ and TTX-4500

Tick ‘Add the footer value to Net Total’

- Fill in the information at sales footer 2 as per below:

Caption: TOURISM TAX (EXEMPTION)

Formula: EMPTY

Tick ‘ Post to G/L Account’ and TTX-4501

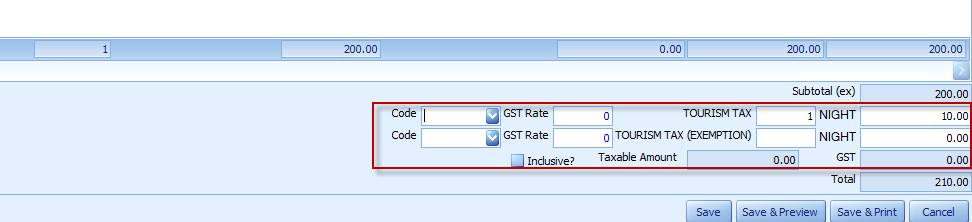

It will display as per below:

The required report format will show as at below:

The required report format will show as at below:

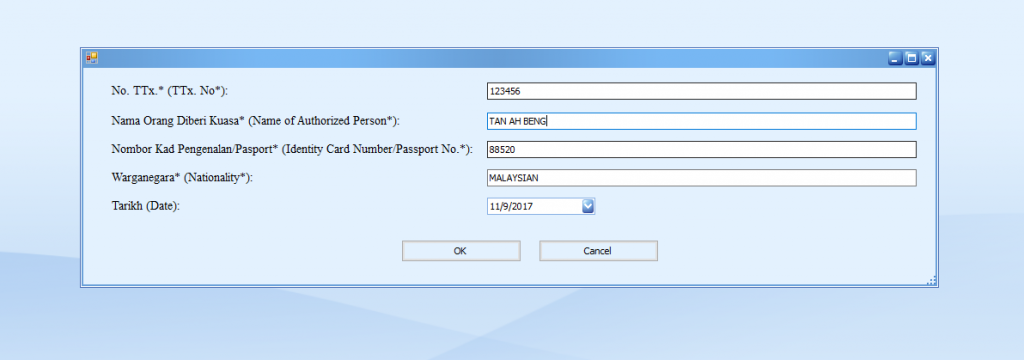

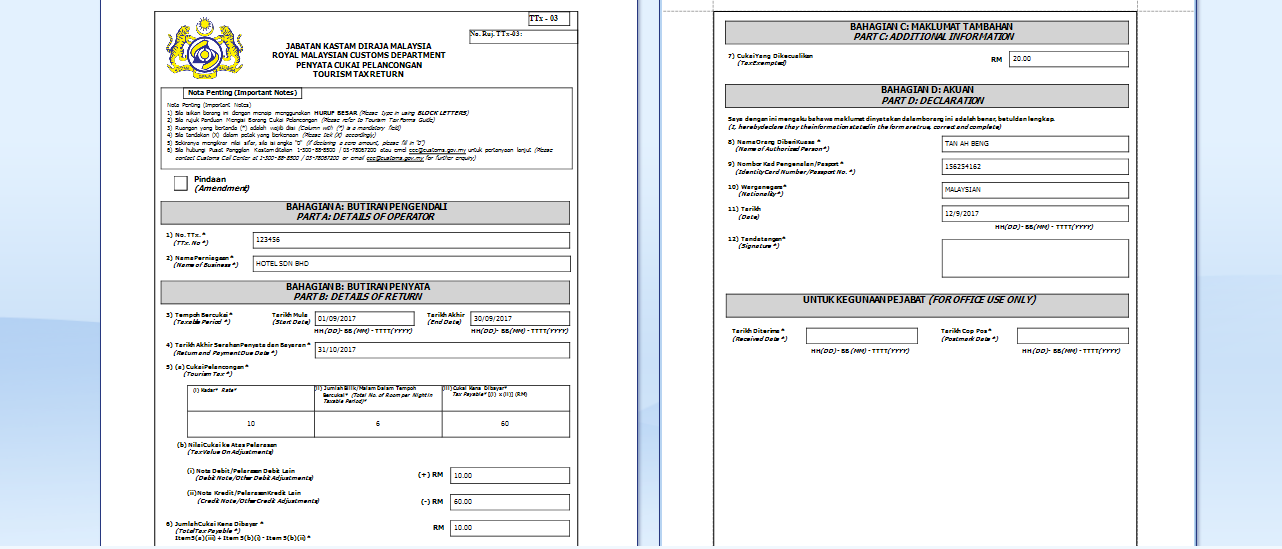

- The TTx-03 Report will show in Invoice/Print Invoice Listing. Filter the date range of your submission and inquiry then preview, select TTx-03 Form, it will prompt as per below:

Fill in related information which will show in Part D: Declaration. - The report format will as per below:

** Kindly take note that all the transactions will not be auto lock *** Please note that must create tourism tax account code TTX-4500 (Tourism Tax) and TTX-4501(Tourism tax Exemption) as the report capture this two account number.