In the modern world, as technology continues to evolve, businesses and governments are constantly seeking ways to streamline operations and improve efficiency.

One such technological advancement that Malaysia is gearing up to embrace with the 12th Malaysia Plan is the implementation of e-invoicing. E-invoicing, or electronic invoicing, promises to revolutionize the way businesses transact, offering a plethora of benefits along with a few challenges.

Why does the government introduce e-invoice?

- E-invoices will help to support the overall growth of digital economy

- Improve Malaysia’s tax administration management efficiency

- Enable Instant/near-instant transaction validation and data storage

- Also align with the 12th Malaysia Plan

- Strengthen digital services foundation

- Digitalize tax administration

- Structured electronic invoices will also

- Help tax authorities collect and process data

- Reduce cases of fraudulent invoices

- Enhance tax compliance and transparency

In the future, unverified invoices will not be eligible for tax reporting.

e-invoice has to be generated in the format of XML and JSON, and to be verified by IRBM (Inland Revenue Board of Malaysia) through MyInvois Portal or API.

Please find out more details of e-invoice guideline year 2023 Inland Revenue Board of Malaysia.

e-Invoice is fully supported in AutoCount Accounting V2.

Overview of e-Invoice

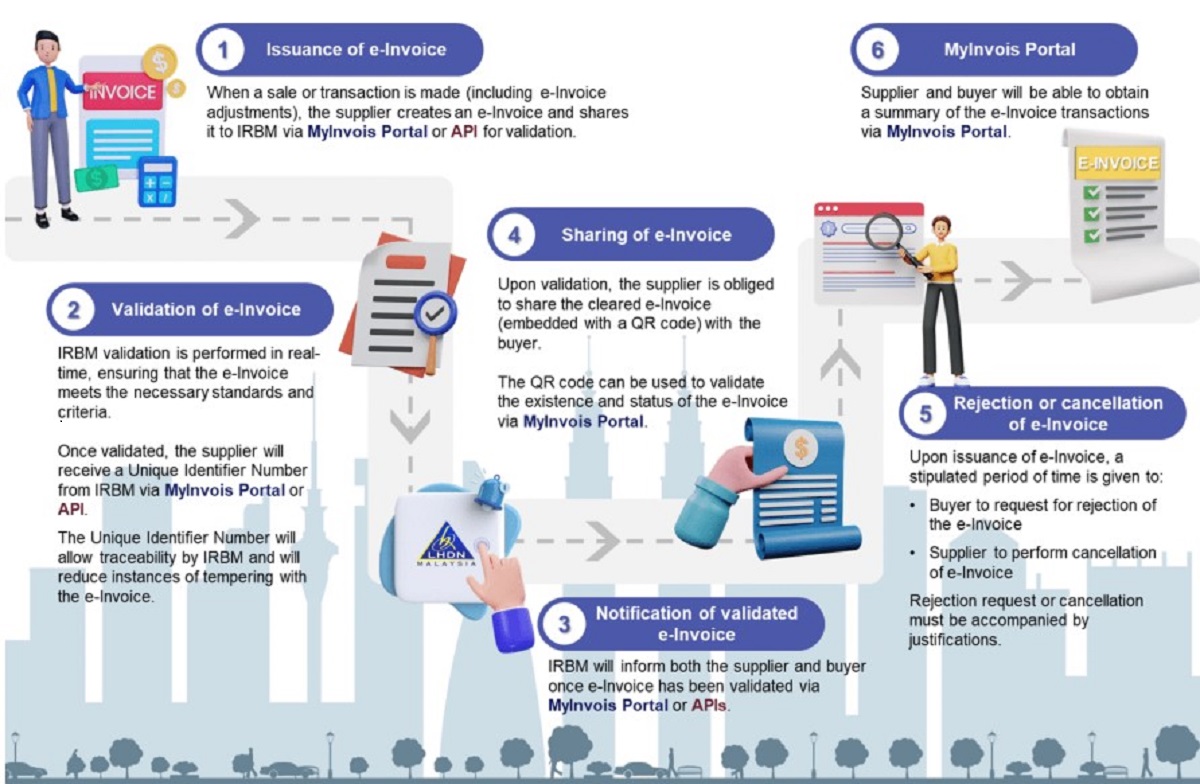

Following is an overview of the e-Invoice workflow. It provides a step-by-step walk through from the pointof sale up to the point of storing cleared e-Invoices on LHDN’s database.

LHDN-eInvoicing-step-by-step-flow